After analyzing statistics on millennial first-time homebuying, it’s clear that buying a home is still part of the American Dream, it is just being accomplished later in life. As I like to look at it, the American Dream hasn’t changed, it just now comes with delayed gratification.

It sounds like the majority of people out there are just like us and hope to one day own a home. But where to start and how to make this dream a reality? As we start to plan for our first time purchasing a home, we’ve combed through numerous best practices, spoken with Mortgage Loan Officers and countless homeowners about their approach and experiences. We’ve compressed all of that into a simple Beginner’s Guide to Homebuying. Enjoy!

Cheat Sheet: First-time Homebuying

- Speak to a professional

- Understand how to qualify for a mortgage

- Get pre-approved for a mortgage

- Find and secure your dream home

- Break-in your new home!

- Optional: Understand how auctions work

- Optional: Common mortgage terms

Steps to Homebuying

1. Speak to a Professional

Congratulations! By reading this, you are off to a great start in educating yourself on the real estate market and homebuying process. There are a ton of great resources out there to further educate yourself, but we recommend at an early stage definitely speaking with a Mortgage Loan Officer (Originator) and realtor. We will chat about shopping around for both of these later, but it is helpful to get in touch with an MLO and realtor to ask any outstanding questions you have about the homebuying process before you dive too deep into the rest of the steps.

2. Secure Your Personal Finance Footprint

There are many factors to go into securing a loan and securing your new home. For many first-time homebuyers, a mortgage is the only way you will be able to afford to purchase a home. After speaking to an MLO, a few factors were more heavily weighted and are important to consider as you begin getting ready to start the homebuying process.

The factors that weighed heaviest on securing a good mortgage rate are:

- Good credit is king

- Your credit score will be a big factor in determining the rates you get as well as how little you will be able to put down.

- The lender we spoke to said that in order to put 3% down, you would need to at least have a FICO score of 680. While each lender will have different requirements, shooting for at least a 680 is a good goal. The higher your credit score the better rates you will be offered.

- In the case that you are applying for a mortgage with your significant other, the lower of your credit scores will be used.

- Put your money where your mouth is

- It’s a common misunderstanding that you need to put 20% down to secure a mortgage. You DON’T. In a lot of cases, you can actually put as little as 3% down. However, the more you put down, the more likely you will get better rates from your lender. Putting down 20% if you are able to will help secure you a better rate and reduce your monthly payment.

- Stay away from debt

- Too much debt not only brings down your credit score but also will be factored into your monthly expenses which in turn will negatively impact your available disposable income upon an MLO calculating your viability to handle a loan. Be sure to keep your debt low wherever possible to better assure your lender you are capable of taking on more debt.

- For the lender we spoke to, your existing debt plus new mortgage payments cannot exceed 45% of your gross income (combined if married). This is another reason it is important to rid yourself of debt prior to applying for a mortgage.

3. Get Pre-Approved

Now that you’ve worked your tail off to reduce your debt, save money, and improve your credit score, you are ready to secure a mortgage. It’s essential that you get pre-approved for a mortgage before beginning the home search because it will show your realtor and the potential seller that you are a serious buyer. If you’re not pre-approved, there is the chance a seller may go with a lesser offer because they know the buyer is good for the money. There’s no time to waste…let’s go mortgage shopping!

Shop around for best rates

Would you buy a car without testing out multiple brands and models? I know I won’t even buy a TV until I have looked at 20 different ones. So shouldn’t the biggest purchase of your life be the same? Forbes reported that “According to research from Freddie Mac, the average borrower could save $1,500 just by getting one extra rate quote when applying for their mortgage. With five quotes, they could save $3,000 or more.” Yet, it’s alarming how many people only get one quote for a variety of reasons. Plan ahead and get many quotes to compare and use as leverage to obtain the best deal.

Lender vs. Broker

First, determine if you want to use a mortgage broker or not. A lender is an entity that will actually be issuing your mortgage loan and providing you the funds to purchase your home. Brokers may have access to a wider array of lenders and could help you compare multiple offers as well as provide expert advice, but they may require a fee at closing.

Compare Apples-to-Apples Terms

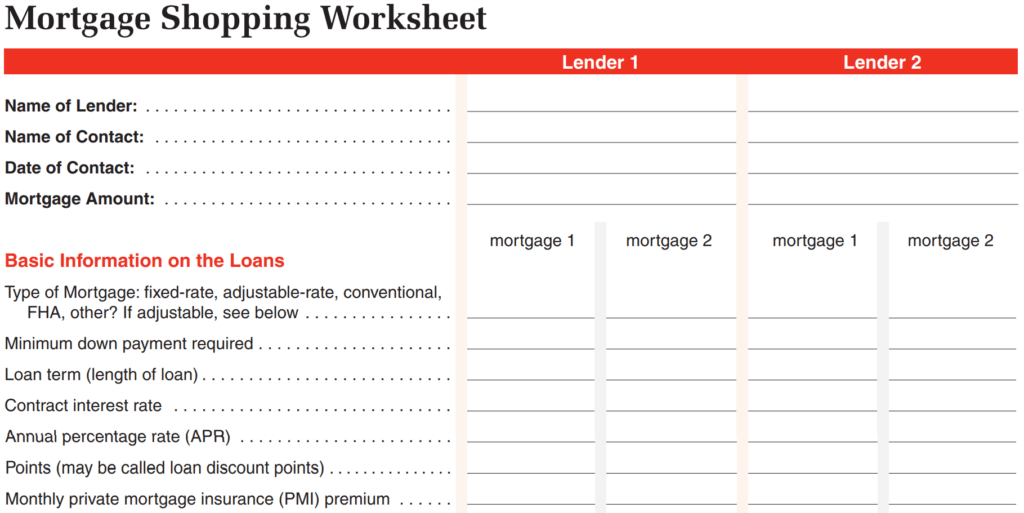

It is important that when you are shopping for mortgage lenders, you are comparing apples to apples. This mortgage shopping comparison worksheet provided by the Federal Trade Commission is a great source to help you compare mortgages at a single lender and across multiple lenders. Be sure to use this in all your lender conversations.

Below are some of the key mortgage loan terms it will be important to grasp prior to these exploratory conversations. Additionally, there are certain best practices or pitfalls to be aware of in relation to each term.

Rates

Definition: This refers to the interest rate, or price that you will have to pay to borrow the money. This is usually represented as a percentage on an annual basis, also referred to as an Annual Percentage Rate (APR).

Types of Rates: There are two types of rates, fixed and adjustable rates. Fixed rates mean the interest rate and monthly payments stay constant over the life of the loan. Adjustable rates are when the rate changes during the life of the loan, following a fixed-rate period, based on movements in an index rate, such as the rate for Treasury securities or the Cost of Funds Index. Fixed rates are more stable and you will always know what your monthly payment is, but should rates drop you would miss out on paying less.

Questions to Ask:

- Just like if you were to call into your cable company, lenders also run promotions and also often have fluctuating rates. Be sure to ask if they are giving you the lowest rates of the day or the week. MLOs may make a commission on the overage (any price a borrower pays above lowest available price), so be sure you’re getting the best rate possible.

- If interested in an adjustable rate, ask how your payments will vary with changing rates.

- Ask them to reveal what is included in the APR? Does it include points, broker fees, and other credit charges or will those be additional charges?

Points

Definition: Also called discount points, one point is equal to 1 percent of the principal amount of a mortgage loan. Lenders often use points to cover fees and origination costs.

Questions to Ask: It is good to ask for points to be quoted as a dollar amount so it is clear how much you will actually be paying and avoid any confusion.

Fees

Definition: Fees are often rolled up into a broader bucket known as origination fees, but can include fees for loan origination, underwriting, brokers, and closing costs.

Questions to Ask:

- Ask your MLO which fees are included in your mortgage transaction.

- Often these fees can be negotiated, so be sure to ask for fees to be dropped or negotiate them down to mitigate your costs.

Loan Terms

Definition: As you’re well aware at this point, buying a home is a HUGE purchase and not something that you will likely be able to pay back over 1 year or even 10 years. This high price tag and subsequent large loan value mean you will likely need more time to pay it back. Your loan term refers to the length in time in which you will have to pay back your loan. This sounds simple, but there are actually many types of loan terms available to you and you will want to understand the differences to pick the one best suited to your financial situation.

Types of Loan Terms

- Fixed-Rate: This is a simple amortization calculation, where monthly payments are made evenly over the life of the mortgage and the interest rate never changes. The most common length is 30 years because this results in the lowest incremental payments. For those that can afford to pay more monthly, a 15 year or shorter term is attractive because you will accrue less in interest over the life of the mortgage. For example, a $1,000,000 mortgage with a 30-year fixed term (360 months) and no interest or fees (this doesn’t exist in real life) would have a monthly payment of $2,777. If you were to take the same scenario but with only a 15-year fixed term (180 months), your monthly payment would be doubled to $5,555.

- Adjustable-Rate Mortgages (ARM): ARMs will include a lower initial fixed rate for a period of time, anywhere from 1 month to 10 years. After that period of time, the rate will be adjusted annually based on market rates. This is beneficial in a lower interest rate environment because your interest rate could decrease, lowering your monthly payment, but the inverse also could happen where you end up paying more when rates increase. An example of this is the popular 5/1 ARM, where a lower fixed rate applies for the first 5 years and then every year after that the rate is updated. Regardless of the type of loan, the term will usually still follow a 30 or 15-year amortization schedule.

Questions to Ask:

- How does the term I select affect the overall cost of the mortgage?

- Can you show me examples of a 5/1 ARM vs. 7/1 ARM vs. 10/1 ARM so I can best compare the impact on my loan?

Best Practice: You can always refinance your mortgage down the line. This enables you to restart your mortgage with new terms. With this in mind, it is best to go with the plan that gives you the lowest interest rate at close since you can always refinance your mortgage should the rates environment become more advantageous than your existing deal.

Down Payment

Definition: The cash you offer as collateral to secure a mortgage.

Best Practices and Tips:

- Often 20% is noted as the expected amount of money to be placed down at loan origination. However, this is not required. You may receive better rates by putting more money down, but in today’s world, 20% can be challenging to save.

- You can put down as little as 3%, but anything under 20% will often require private mortgage insurance (PMI). PMI protects the lender in case the borrower is unable to make payment. While this allows you to purchase a home with less money down, you will need to add this premium to your monthly payment and should be avoided whenever possible.

Questions to Ask:

- Is PMI required if I put less than 20% down?

- How does different down payment amounts affect my interest rates and fees?

Non-Conventional Mortgages

In an effort to promote first-time homeownership and to benefit those that may greatly benefit from additional support, there are many first-time homebuyer programs. Definitely worth looking into these and seeing if you qualify or if they can be of assistance in your homebuying journey.

Many home purchasing assistance programs differ by state. You can find the programs that are available in your state here.

FHA Loans: This is a loan that is federally-insured and allows borrowers with lower credit scores and less capital available for a down payment to still qualify for a mortgage. If you have a 580+ credit score, you can put as little as 3.5% down. If you have a credit score between 500-579, you can put as little as 10% down. The catch is that you still need to take out PMI. You can find out more about FHA loans here.

USDA Loan: Similar to the FHA loans, this is designed to help those most in need by allowing for zero down payment and allows for lower credit scores. It focuses on rural and surrounding suburbs and each region carries different loan limits. You can find out if you qualify here.

VA Loan: VA loans are available for Service Members, veterans, and surviving spouses. You will still obtain this loan through private lenders, but Veteran Affairs guarantees part of the loan which will enable better mortgage terms. You can find out more about VA loans here.

NADL Loan: Similar to the VA loan described above, this loan is available to veterans with Native American heritage. You can find out more about NADL loans here.

Teacher Next Door Program: This program was formed to increase homeownership among teachers, but has since expanded to other public servants such as police officers, firefighters, nurses, medical professionals, government workers, and others. The program helps connect public servants with homebuying support through down payment assistance, grants, and other great benefits. You can find out more about the Teacher Next Door Program here.

If none of these are the right fit for you, you can check out more first-time homebuyer programs here.

Everything is Negotiable

Now that you’ve shopped around multiple lenders and compared their apples-to-apples offers, it’s time to get down to business. No different than if you are buying a car or negotiating a tense Snackables for brownie trade during third-grade lunch, negotiation is key. This is a loan that you will be paying back for potentially 30 years and now is the time to make sure you get the best deal possible. NEGOTIATE, NEGOTIATE, NEGOTIATE! I like to believe it never hurts to ask, so be sure to ask for all discounts, dive into the fees and see what you can get removed, and even feel free to use other loan offers as leverage. Either way the lender is going to be making money off of you, so try and sweeten the deal in your favor however possible.

Lock It In

You’re sweating bullets, having just negotiated your mortgage like you were on Shark Tank and you get the terms you’re happy with. Hallelujah! All that is left is to Lock It In and tell your loan originator they have a DEAL!

What this does is secure an agreement with your lender locking in the rate. This should include the rate agreed upon, the period the lock-in lasts and the number of points to be paid. You may be charged a fee to lock-in the rate, but see if the lender will refund that upon closing. Congratulations! You just secured your first mortgage and are now on the clock to find the home of your dreams.

4. Finding Your Dream Home

Now that you’re pre-approved for a mortgage, you have signalled to realtors and sellers that you are serious and are ready to mingle. Now you need to get out there and find your dream home.

To help navigate this stage of your homebuying journey, follow these steps.

- Narrow the location

- It’s important to start with where you want to live so that you can get a sense of home prices, market trends and find the right realtor. Sometimes a mile or block can make a big difference in home prices, so starting with this is an important factor in pricing.

- A few important elements to consider when picking your location:

- Commute distance

- School districts

- Crime rates

- Home price trends

- City taxes

- Beyond these, you will want to find a community that personally supports your interests and elements most important to you. For instance, if living in Southern California near the beaches are important, you likely won’t want to live inland but will need to expect to spend more as you get nearer the beach.

- Select a realtor

- Now that you have a general idea where you want to live, find a realtor that is an expert in that area who can provide added value beyond just negotiating a contract. If they know the minute nuances that make one neighborhood safer, or better value, lower HOAs, etc, this will help expedite your search and reassure you have a trusted partner.

- As a licensed realtor under Berri Real Estate, I would recommend reaching out to them or myself if you’re looking to buy or sell a home in the Bay Area.

- Be realistic on what you can afford

- This is a critical step in the process. You may have qualified for a $1M mortgage loan, but that didn’t account for your early retirement and college savings goals. When you look at your financial situation holistically, it actually might only make sense to purchase a home for $750K. Only you know what you truly can afford and be sure to stick to your guns. If this means getting a starter home and upgrading in a couple years, that might be the best solution for you at this time.

- Be sure to also factor in the additional costs beyond your mortgage monthly payments, such as property taxes, property insurance, utilities, HOA fees, and overall maintenance costs.

- Identify deal breakers and nice-to-haves

- If you’re anything like us, you’re addicted to HGTV and have an elaborate list of what needs to be included in your dream home. If you have enough money, then sure, you can have all the bells and whistles you want. Chances are that when you consider community, square footage, bed and bathroom count, lot size, schools, finishes, and so many more details, something is going to have to give. Be honest with yourself and determine which factors are deal-breakers and which you can live without.

- Look at multiple homes

- After selecting your realtor and identifying a general area in which you want to live, be sure to look at multiple homes before agreeing to one. This is not an endorsement of indecisiveness, but instead a call to action to be prudent in this decision. Try to see multiple homes in a short time span so you can internally compare the pros and cons of different types of houses, pricing, etc.

- Make an offer

- The moment has arrived! You looked at many homes and finally found the one you love. Now is the time to take that faithful leap and place an offer on the house. This is where your realtor’s expertise will have a big impact. Lean on your realtor to help you identify the right amount to offer based on the location, how long the house has been on the market, and all the other factors involved in a real estate transaction.

- Depending on the competition, you may be able to save some money by placing a below-asking-price offer, but it is a fine balancing act to not upset the seller or miss out to other potential buyers. Trust your gut and your realtor’s advice when it comes to making an offer.

- You can also attach stipulations to your offer, such as negotiating who pays closing costs or dependence on inspections.

- Finalizing an accepted offer

- You get the call from your realtor, excitement in their voice and you hear the words “YOU GOT THE HOUSE!” Now all that is left to do is to finalize the deal. The period from accepted offer to when you have the keys to your dream home in your hand is known as escrow. During this time you will sign all documentation, facilitate all inspections, and pay all closing costs. According to a Zillow study, average closing costs are $3,700, so plan for those additional costs.

Auction Purchases

Purchasing a home through an auction is another, albeit, much riskier option to homeownership. Auctions occur when homeowners are unable to pay the debts against their homes and lenders place the property under foreclosure and begin actions to evict the current occupants. In these scenarios, the lender will put the house up for auction, often at highly reduced rates. Auctions present a huge opportunity to purchase a house at a discounted rate, but there are some very important considerations to understand before going down this route.

First, many auctioned houses do not allow you to inspect the inside of the home prior to the auction and subsequent bidding. While the outside of the home might be in good condition, there is a good chance the inside is riddled with problems likely due to a lack of upkeep from irritated previous owners. To limit this risk, try to find auctions that will allow for a pre-auction inspection.

Second, it is important to understand the local housing market and make sure that you do not overbid for a house. Try to involve a trusted realtor or appraiser to assist in evaluating the auction property.

A third potential pitfall is that if you win the bid, you not only own the keys but now own all the debt and liens that may exist against the property. Be sure to do your due diligence in making sure there are no outstanding debts you will inherit with this property transaction. You can also take out title insurance for some extra protection.

Fourth, expect to pay CASH MONEY for this house. That is right, most auctions require a deposit of 5-10% just to participate in the auction, and then if you win you will need to pay in cash or cashier’s check. This requirement alone likely makes it hard for most first-time homebuyers to participate. No shame here, saving up for a 10% down payment seems like a huge hurdle, let alone 100%.

If all of those considerations for an auction home purchase, then start doing your research and best of luck in securing a great deal. RealtyTrac is a good resource to find available properties for auction.

5. You Did It!

Congratulations! It was a long journey, but you did it. You accomplished the American Dream, owning a home where you can grow roots and not to mention the land that the house sits on. Actually owning part of America is a pretty cool thing to have accomplished, and you did it through hard work and planning.

Now go fire up the grill, call your friends over, and break in your new home!

Check out additional topics to make personal finance SLIGHTLY EDUCATIONAL on our Personal Finance page.

Helpful Mortgage Glossary

A lot of terms were discussed in this article and many more exist in the homebuying process that we didn’t touch on. Below is a list of helpful mortgage terms that were identified by the Federal Trade Commission.

- Adjustable-rate mortgage (ARM) — A mortgage that does not have a fixed interest rate. The rate changes during the life of the loan based on movements in an index rate, such as the rate for Treasury securities or the Cost of Funds Index. ARMs usually offer a lower initial interest rate than fixed-rate loans. The interest rate fluctuates over the life of the loan based on market conditions, but the loan agreement generally sets maximum and minimum rates. When interest rates increase, generally your loan payments increase; when interest rates decrease, your monthly payments may decrease. For more information on ARMs, see the Consumer Handbook on Adjustable Rate Mortgages.

- Annual percentage rate (APR) — The cost of credit expressed as a yearly rate. For closed-end credit, such as car loans or mortgages, the APR includes the interest rate, points, broker fees, and certain other credit charges that the borrower is required to pay. An APR, or an equivalent rate, is not used in leasing agreements.

- Conventional loans — Mortgage loans other than those insured or guaranteed by a government agency such as the FHA (Federal Housing Administration), the VA (Veterans Administration), or the Rural Development Services (formerly known as the Farmers Home Administration or FmHA).

- Escrow — The holding of money or documents by a neutral third party before closing on a property. It can also be an account held by the lender (or servicer) into which a homeowner pays money for taxes and insurance.

- Fixed-rate loans — Loans that generally have repayment terms of 15, 20, or 30 years. Both the interest rate and the monthly payments (for principal and interest) stay the same during the life of the loan.

- Interest rate — The price paid for borrowing money, usually stated in percentages and as an annual rate.

- Loan origination fees — Fees charged by the lender for processing a loan; often expressed as a percentage of the loan amount.

- Lock-in — A written agreement guaranteeing a homebuyer a specific interest rate on a home loan provided that the loan is closed within a certain period, such as 60 or 90 days. Often the agreement also specifies the number of points to be paid at closing.

- Mortgage — A contract, signed by a borrower when a home loan is made, that gives the lender the right to take possession of the property if the borrower fails to pay off, or defaults on, the loan.

- Overages — The difference between the lowest available price and any higher price that the homebuyer agrees to pay for a loan. Loan officers and brokers are often allowed to keep some or all of this difference as extra compensation.

- Points (also called discount points) — One point is equal to 1 percent of the principal amount of a mortgage loan. For example, if a mortgage is $200,000, one point equals $2,000. Lenders frequently charge points in both fixed-rate and adjustable-rate mortgages to cover loan origination costs or to provide additional compensation to the lender or broker. Points are paid usually on the loan closing date and may be paid by the borrower or the home seller, or split between the two parties. In some cases, the money needed to pay points can be borrowed but increases the loan amount and the total costs. Discount points (sometimes called discount fees) are points that the borrower voluntarily chooses to pay in return for a lower interest rate.

- Private mortgage insurance (PMI) — protects the lender against a loss if a borrower defaults on the loan. It is a payment usually required of a borrower for loans in which a down payment is less than 20 percent of the sales price or, in a refinancing, when the amount financed is greater than 80 percent of the appraised value. When you acquire 20 percent equity in your home, PMI is canceled. Depending on the size of your mortgage and down payment, these premiums can add $100 to $200 per month or more to your payments.

- Settlement (or Closing) costs — Fees paid at a loan closing. May include application fees; title examination, abstract of title, title insurance, and property survey fees; fees for preparing deeds, mortgages, and settlement documents; attorneys’ fees; recording fees; estimated costs of taxes and insurance; and notary, appraisal, and credit report fees. Under the Real Estate Settlement Procedures Act, the borrower receives a “good faith” estimate of closing costs within three days of application. The good faith estimate lists each expected cost either as an amount or a range.

- Thrift institution — A term generally describing savings banks and savings and loan associations.