It is clear that Americans lack a strong grasp of basic financial literacy (see more in the introduction to this personal finance course). While only 20% of millennials have a baseline understanding of financial literacy, the good news is that anyone can learn how to make a budget and evolve their relationship with money.

The quintessential step to financial independence is to understand the basics of budgeting. Budgeting is the act of creating a plan on how you are going to spend (or save) your money. Budgeting is important to understand whether you’re figuring what to do with the money you made from your salary or if you’re running a Fortune 500 company. The great thing is that the foundations of budgeting don’t change much with scale (if you don’t count the more complicated accounting practices). So, let’s dive into the fundamentals of budgeting.

What is a Budget?

Money In – Money Out = Left Over Money

The simplified version of a budget is based on an elementary formula: Money In ⎯ Money Out = Left Over Money. If we were to get a little more technical, this is often described as Income – Expenses = Net Income. Ultimately, your available money is determined by taking all of your available cash and subtracting any of your expenditures. There are situational exceptions to this when you start to consider cash flows and credit, but for now, we are going to just focus on available cash.

How to Make a Budget?

How to Calculate Money In?

For most cases, calculating the “money in” is pretty straightforward, just add up your weekly or bi-weekly paychecks from your job. Some people may have multiple revenue streams or investments, but for this example, we are going to assume a $50,000 salary with bi-monthly paychecks.

Pre-tax, your $50,000 salary translates to gross semi-monthly earnings of $2,083. This is a good chunk of money, but unfortunately, there are still a lot of deductions that need to be made before that money makes its way into your bank account. These deductions include federal and state taxes, Social Security, medical coverage, and other benefit-related deductions. By the time your earnings make it to your bank account, your take-home pay or income is $1,593, or 76% of your gross earnings. Using a useful paycheck calculator on SmartAsset, you can use your individual financial situation to calculate your own take-home pay.

While a large portion of your gross salary is being deducted, you should also strongly consider contributing to a retirement account such as a 401K.

The important point to take away from this example is the importance of understanding what your take-home salary is on a monthly basis. The money that ends up in your bank account is the foundation for building your budget. In this example, the monthly take-home income is $3,186 (2 x $1,593).

Money In = $3,186

How to Calculate Money Out?

Now that we’ve deciphered how to determine your income, let’s talk about the other half of budgeting…expenses.

Types of Expenses

Fixed Costs

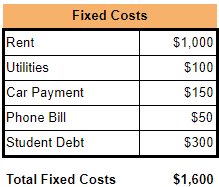

Fixed costs often make up the largest portion of your monthly expenses. Fixed costs are expenditures that are consistently similar each month and often are obligated to be paid due to a contract or agreement. Some examples of fixed costs are rent or mortgage, car payments, utilities, tuition, student debt payment, etc. These often are the largest portion of expenses because they involve larger commitments that are also essential to our everyday lives.

For this example, let’s assume the below are your fixed costs equaling $1,600.

Variable Costs

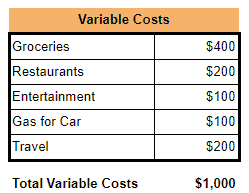

Variable costs are expenditures that fluctuate, depending on your actions. For example, your expenses associated with dining out will fluctuate if you go to a restaurant ten times per month vs. only three times per month. Variable costs are the most important line items to watch in a budget because even the best-balanced budgets can be worthless if you are not accurately tracking the expenses associated with your decisions or you are lacking responsibility when it comes to your voluntary purchases.

In today’s world of contactless payments and the gamification of credit cards, it is easy to lose track of your variable expenses. Once you set a budget, the best way to avoid falling victim to overspending is to reassess your purchases and budget on a weekly or even daily basis.

For this example, let’s assume the below are your variable costs equaling $1,000.

Now it’s time to tally up your monthly expenses. To do so, you add your Fixed Costs and Variable Costs.

Fixed Costs + Variable Costs = Total Expenses

$1,600 + $1,000 = $2,600

Money Out = $2,600

How to Calculate Left Over Money and What to Do With it?

Great job! We’ve figured out what our take-home income is as well as our monthly total expenses. Now it’s just some simple arithmetic to calculate our remaining money.

Money In – Money Out = Left Over Money

$3,186 – $2,600 = $586

Left Over Money = $586

The goal of every good budget is to maximize the remaining money after expenses. If you run a budgeting exercise and your remaining money ends up negative, then you have a big problem. You will need to cut back your expenses or find ways to increase your income so that your income exceeds your expenses. Here are some side-hustle ideas to help improve your income through secondary workstreams.

Whether you have $1 leftover or $1,000, now it’s up to you to figure out what to do with that money. In our Beginner’s Guide to Investing, we outlined our recommended prioritized order of how to use your remaining money. The cheat sheet version is:

- Build up emergency savings equal to 6-8 months of expenses

- Fund retirement accounts such as 401Ks and IRAs

- Invest in the stock market

Additionally, it is important to enjoy the life you are living. So, if you want to go on a big trip or see your favorite band in concert, make sure you begin saving for that.

Best Ways to Manage Budgets

Regardless of how complicated your financial situation is, it is critical to have a strong handle on your budget. This can be done using your own templates in a notebook or on Excel, but there are some outstanding automated budgeting tools available to you.

A few budgeting tools we recommend:

- Your bank may offer a budget tool for free

- Intuit Mint – This is my personal favorite, allowing me to connect all of my financial accounts, build budgets and set goals

- PocketGuard

- Clarity Money backed by Goldman Sachs

- Personal Capital

- YNAB (You Need a Budget)

Other Budget Considerations

We’ve outlined how to budget in a fairly straightforward example, but there are some key budget considerations to be aware of to avoid common pitfalls.

Cash Flow

Cash flow involves the available money as it relates to inflows and outflows of money. The best way to think about this is to take a snapshot of your bank account and at that moment, that is your available liquid spending power. This is relevant because when you build out a budget, it is important to consider when throughout the month you have to pay bills in relation to when your income is received. If your phone bill is due on the 13th of the month, but you don’t get paid until the 15th of the month, you need to ensure that you accounted for your phone bill when you received your last paycheck and put enough money away to cover it. Just looking at monthly totals doesn’t tell the whole financial picture and cash flows should always be taken into account.

One useful way to help manage cash flows is to work with your service providers or lenders to pick the day of the month that your payments are due. For instance, if you know the leftover money from your first paycheck of the month will not be able to cover your phone bill, you can request that the service provider move the due date to the 18th of the month (for example) so you can cover the cost with your 15th of the month paycheck.

Interest

It’s important to consider the impact interest rates will have on your budget, as they can quickly contribute to a fiscally challenging position. This impact is often most-heavily felt in relation to loans and credit card balances. Credit cards have developed a gamified system where you earn benefits for spending money. This is awesome if you are able to pay off your balance each month because you are earning rewards for spending money you needed to spend anyways. This gamification is dangerous if you are unable to pay off your credit card balance every month and incur interest fees. Some credit cards carry interest rates as high as 28% and if you are already struggling to keep up with payments, this monthly compounding at such a high rate could make it impossible to stay out of debt.

On the flip-side, interest rates can work in your favor if you are saving your money in a high-yield savings account instead of just a checking account. In this scenario, the money you are saving is actually working for you and could bring in as high as a couple of percentage points monthly. This may not seem like a lot, but thanks to compounding, this can really add up.

Now that you are a budgeting expert, go take back your financial freedom and begin building your future wealth!

Check out additional topics to make personal finance SLIGHTLY EDUCATIONAL on our Personal Finance page.